Event

Global Logistic Properties (GLP) will co-invest with GIC to acquire one of the largest logistics real estate portfolios in the US for US$8.1 billion. GLP will initially hold a 55% stake in the GLP US Income Partners I and GIC 45%. GLP intends to reduce its stake to 10% by August 2015 and has already received strong interest from capital partners.

Impact

US transaction details. The US$8.1bn portfolio is acquired at a significant discount to replacement cost. The in-place cap rate is 6.0% and in-place rent is US$4.83 per square feet per year. In-place rents are about 7% below market. The portfolio is 90% leased with a near-term target to reach 95%. This will put GLP as the third largest player in the US logistics space by lease area with 117m sq ft of space, after Prologis and Duke Realty. The portfolio is spread across 36 sub-markets in the US and has 3,500 plus customers with the top 10 accounting for 9% of lease area.

Sell-down from 55% to 10% by August 2015. GLP’s initial equity commitment will be funded by cash on hand and a short-term credit facility. The group’s final 10% stake represents US$330m of equity or approximately 4% of GLP’s net asset value.

Assets under management +61% to US$21.3bn. GLP expects this investment to generate a pre-tax cash-on-cash yield of 9% in the first year, comprising share of operating results and fund management fees.

Price catalyst

12-month price target: S$3.26 based on a Sum of Parts methodology.

Catalyst: Faster pace of development starts in China; positive leasing momentum; successful sell-down of GLP US Income Partners I before August 2015.

MER’s action and recommendation

GLP offers a direct proxy to China’s (65% of NAV) growing logistics sector, which is well-supported by a rising urbanisation rate and resilient domestic consumption. MER believes the entry into the US logistics market is positive given the 9% cash-on-cash pre-tax yield in the first year. MER maintains an Outperform rating on GLP.

Wednesday, December 10, 2014

Wednesday, December 03, 2014

OUEHT’s $495m Acquisition To Boost Yields?

Last week, OUE Hospitality Trust (OUEHT) announced its decision to acquire Crowne Plaza Changi Airport (CPCA) and its extension (CPEX) from OUE. OUE is also OUEHT’s vendor and sponsor.

The properties will be purchased for a consideration of $290 million and $205 million respectively. InterContinental Hotels Group will continue to be the manager of the hotel after the acquisition.

CPCA which is located beside Changi Airport Terminal 3 has 320 rooms and has been in operations since 2008.

CPEX will be located beside CPCA and connected through a link bridge will add 243 rooms to the airport hotel bringing it to a total of 563 rooms. The extension is expected to be completed by end of 2015.

This acquisition will be split into two phases with CPCA first, followed by CPEX after it has obtained its temporary occupation permit. To have a better projection of the hotel operations after expansion, the acquisition of CPEX will be priced now.

OUEHT expects CPCA to have an annualized yield of 4.5 percent and a combined yield of 4.6 percent post expansion. The acquisition will be funded through debt and/or equity, with the decision for which funding to pursue decided during the upcoming AGM of OUEHT.

Like its other hotel, OUEHT will lease the airport hotel back to its vendor under a Master Lease agreement composing of a fixed and variable rent based on performance of the property.

CPCA will have a fixed rent of $12.5 million while the post expansion hotel will have a fixed rent of $22.5 million. This agreement will expire in May 2028 with the vendor having an option to renew the lease for an additional two consecutive five years term.

In view of this development, analysts from OSK-DMG Research upgraded OUEHT to a “Buy” call with a higher target price of $0.97. They cited the yield accretion and the opportunity for the trust to own a global brand name hotel asset as the main reasons for rerating.

The properties will be purchased for a consideration of $290 million and $205 million respectively. InterContinental Hotels Group will continue to be the manager of the hotel after the acquisition.

CPCA which is located beside Changi Airport Terminal 3 has 320 rooms and has been in operations since 2008.

CPEX will be located beside CPCA and connected through a link bridge will add 243 rooms to the airport hotel bringing it to a total of 563 rooms. The extension is expected to be completed by end of 2015.

This acquisition will be split into two phases with CPCA first, followed by CPEX after it has obtained its temporary occupation permit. To have a better projection of the hotel operations after expansion, the acquisition of CPEX will be priced now.

OUEHT expects CPCA to have an annualized yield of 4.5 percent and a combined yield of 4.6 percent post expansion. The acquisition will be funded through debt and/or equity, with the decision for which funding to pursue decided during the upcoming AGM of OUEHT.

Like its other hotel, OUEHT will lease the airport hotel back to its vendor under a Master Lease agreement composing of a fixed and variable rent based on performance of the property.

CPCA will have a fixed rent of $12.5 million while the post expansion hotel will have a fixed rent of $22.5 million. This agreement will expire in May 2028 with the vendor having an option to renew the lease for an additional two consecutive five years term.

In view of this development, analysts from OSK-DMG Research upgraded OUEHT to a “Buy” call with a higher target price of $0.97. They cited the yield accretion and the opportunity for the trust to own a global brand name hotel asset as the main reasons for rerating.

Thursday, November 20, 2014

王馨平12月来新会粉丝

90年代凭一曲《别问我是誰》唱响歌坛的歌手王馨平12月将来新宣传新辑,并与粉丝近距离接触。这也是她10多年后再度有机会与新加坡歌迷近距离见面和互动。

王馨平2001年与金融才俊Stephen Lee结婚后,便淡出娱乐圈,直到2011年以专辑《馨情》复出。2014年,王馨平再出发,推出专辑“Truly”,重新演绎10首她最爱的国、粤语经典,包括黎明《今夜你会不会来》、张信哲《爱如潮水》、陈奕迅《单车》等等。

王馨平2001年与金融才俊Stephen Lee结婚后,便淡出娱乐圈,直到2011年以专辑《馨情》复出。2014年,王馨平再出发,推出专辑“Truly”,重新演绎10首她最爱的国、粤语经典,包括黎明《今夜你会不会来》、张信哲《爱如潮水》、陈奕迅《单车》等等。

此趟来新,王馨平将在12月20日(7:30pm)在Bookfest举办个人签唱会,并于12月21日(2pm)在Popular@Causeway Point举行另一场见面会。

Wednesday, November 05, 2014

OUE Hospitality Trust - Room to grow amid stability

Strong quarter

OUE Hospitality Trust (OUE-HT) delivered S$21.7m distributable income and DPU of 1.64Scts, beating forecast made during its IPO by 2.7% and 2.5% respectively. On a qoq basis, Mandarin Orchard Singapore (MOS) recorded better room revenue, achieving higher RevPAR of S$252 (vs.S$242 in 2Q14), while occupancy remained above 90%. The higher room rates were mainly a result of i) the 160 refurbished rooms that was completed in 2Q ii) higher corporate patronage and iii) stronger food & beverage sales. Mandarin Gallery’s (MG) similarly contributed higher gross revenue, achieving average rental reversion of 4.7% and registering a passing rent of S$23.9 psf/mth (vs S$23.7 psf/mth in 2Q14).

Further room to grow both organically and inorganically

Looking ahead, with i) the decline in visitor arrival stabilizing; ii) Singapore is scheduled to host more major international sporting events and iii) the government’s effort in revitalising Orchard Road into a vibrant lifestyle destination, OUE-HT is well-positioned to benefit from the stronger outlook. Given its locality coupled with the continual demand for prime Orchard road space, we believe management could continue to achieve positive rental reversion when renewing the 44% (by gross rent) of lease in MG that is due to expire in FY15. Inorganically, Crowne Plaza Hotel at Changi Airport is expected to be the next acquisition target.

Maintain Add

With c.62% of income attributed from fix rent, OUE-HT’s earnings are more defensive than its peers. Currently, offering dividend yield of 7.7% for FY15 while trading at 1.0x P/BV vs. yield of 7.3% and 1.0x P/BV for its peers, we continue to see value in OUE-HT and have maintained our Add rating.

OUE Hospitality Trust (OUE-HT) delivered S$21.7m distributable income and DPU of 1.64Scts, beating forecast made during its IPO by 2.7% and 2.5% respectively. On a qoq basis, Mandarin Orchard Singapore (MOS) recorded better room revenue, achieving higher RevPAR of S$252 (vs.S$242 in 2Q14), while occupancy remained above 90%. The higher room rates were mainly a result of i) the 160 refurbished rooms that was completed in 2Q ii) higher corporate patronage and iii) stronger food & beverage sales. Mandarin Gallery’s (MG) similarly contributed higher gross revenue, achieving average rental reversion of 4.7% and registering a passing rent of S$23.9 psf/mth (vs S$23.7 psf/mth in 2Q14).

Further room to grow both organically and inorganically

Looking ahead, with i) the decline in visitor arrival stabilizing; ii) Singapore is scheduled to host more major international sporting events and iii) the government’s effort in revitalising Orchard Road into a vibrant lifestyle destination, OUE-HT is well-positioned to benefit from the stronger outlook. Given its locality coupled with the continual demand for prime Orchard road space, we believe management could continue to achieve positive rental reversion when renewing the 44% (by gross rent) of lease in MG that is due to expire in FY15. Inorganically, Crowne Plaza Hotel at Changi Airport is expected to be the next acquisition target.

Maintain Add

With c.62% of income attributed from fix rent, OUE-HT’s earnings are more defensive than its peers. Currently, offering dividend yield of 7.7% for FY15 while trading at 1.0x P/BV vs. yield of 7.3% and 1.0x P/BV for its peers, we continue to see value in OUE-HT and have maintained our Add rating.

Thursday, October 30, 2014

Sheng Siong Group - A place to hide

Efficiency gains here to stay…

9M14 gross margins improved to 24.2% from 23.0% (9M13), in line with our projections. This was despite food inflation for 9M14 coming in at 2.9% and increasing labour costs. Efficiencies from operating the Mandai distribution hub continue to reap cost savings and margins will continue to improve as more stores are added to the current 33 stores, given the current distribution hub utilisation rate of only about 70-75%.

…and effective cost management

Rising manpower costs and human resource shortages have plagued the industry over the past year. We see competitors such as Giant struggling to keep stores open as manpower becomes more of an issue. In contrast, Sheng Siong has managed this particularly well. Its administrative expenses increased from 16% of sales in 9M13 to 16.2% in 9M14 on higher employee bonuses, while its rental cost has remained stable at 2.6% of revenues.

No growth yet for FY15, but has cash and pays dividends

Flushed with cash (~S$178.7m) and armed with a track record of opportunistic store expansions during market downturns (three new outlets during the Asian financial crisis over 1995-2000; and 14 outlets during the 2000-2005 Dot-Com crash), Sheng Siong looks set to embark on another round of outlet expansions given the slowing regional growth and a falling Singapore property market. Its current share price implies an FY14 dividend yield of ~4.6% (FCF yield ~5%) and valuations at this level are undemanding. Immediate catalysts for the stock include 1) concrete outlet expansion plans, and 2) more visibility for its China expansion.

9M14 gross margins improved to 24.2% from 23.0% (9M13), in line with our projections. This was despite food inflation for 9M14 coming in at 2.9% and increasing labour costs. Efficiencies from operating the Mandai distribution hub continue to reap cost savings and margins will continue to improve as more stores are added to the current 33 stores, given the current distribution hub utilisation rate of only about 70-75%.

…and effective cost management

Rising manpower costs and human resource shortages have plagued the industry over the past year. We see competitors such as Giant struggling to keep stores open as manpower becomes more of an issue. In contrast, Sheng Siong has managed this particularly well. Its administrative expenses increased from 16% of sales in 9M13 to 16.2% in 9M14 on higher employee bonuses, while its rental cost has remained stable at 2.6% of revenues.

No growth yet for FY15, but has cash and pays dividends

Flushed with cash (~S$178.7m) and armed with a track record of opportunistic store expansions during market downturns (three new outlets during the Asian financial crisis over 1995-2000; and 14 outlets during the 2000-2005 Dot-Com crash), Sheng Siong looks set to embark on another round of outlet expansions given the slowing regional growth and a falling Singapore property market. Its current share price implies an FY14 dividend yield of ~4.6% (FCF yield ~5%) and valuations at this level are undemanding. Immediate catalysts for the stock include 1) concrete outlet expansion plans, and 2) more visibility for its China expansion.

Sunday, October 26, 2014

《军中乐园》Paradise In Service SG Promo Tour

Arrival in Singapore

Date: 27 October 2014

Time: 12pm

Flight No: BR225 (Terminal 1)

Meet-and-Greet

Date: 27 October (Mon)

Time: 7pm

Venue: Bedok Mall

Departure

Date: 28 October (Tues)

Time: 1.10pm

Flight no: BR226 (Terminal 1)

Friday, October 17, 2014

Opening of GIUDI's flagship store - Media Invitation (161014)

I was invited to the exciting flagship store opening in Mandarin Gallery.

This will be Asia’s first GIUDI store!

The brand offers products made from high quality Italian leather at an affordable price range.

GIUDI leather is certified by VERA PELLE ITALIANA consortium, which classified it as genuine Italian leather.

All leathers have been tanned exclusively with natural tannins of vegetable origins and does not contain substances prohibited by law.

The designs are exclusive and unique to GIUDI, with some designs crafted solely for the Asian market in limited quantities.

To celebrate the grand opening, GIUDI has prepared leather keychains worth $80, complimentary with every bag purchase.

GIUDI - Mandarin Gallery Boutique is located at 333A Orchard Road #02-21

Operating Hours: 10am – 9pm T: 6733 5389

Wednesday, October 15, 2014

Project SuperStar 《绝对SuperStar》

This Saturday 1.30pm at Bedok Point, come meet our Top 4 finalists, hostDasmond Koh, Manager Chan, Manager Pow and YES 933 DJ: Kunhua 坤华!

*First 100 fans will get to go on stage for an autographed poster of the Top 4, plus receive a goodie bag. Passes will be distributed at 12pm. Chance to win Grand Final tickets during our Q&A session too!

*First 100 fans will get to go on stage for an autographed poster of the Top 4, plus receive a goodie bag. Passes will be distributed at 12pm. Chance to win Grand Final tickets during our Q&A session too!

Wednesday, October 08, 2014

Mapletree Greater China Commercial Trust

MGCCT has performed well financially for its first full fiscal period after its IPO, with FY14 revenue and DPU exceeding its projections. We see continued organic growth from MGCCT’s resilient portfolio, underpinned by further positive rental reversions. We value MGCCT using the dividend discount model (DDM) as it is expected to pay out stable rental income (net of expenses) generated from its assets at regular intervals. We derive a fair value estimate of S$1.00 for MGCCT after inputting our financial forecasts and CAPM assumptions (cost of equity: 8.2 per cent; terminal growth rate: 2.0 per cent) in our model. Coupled with an attractive FY15F distribution yield of 7.0 per cent, this translates into total potential returns of 18.1 per cent. MGCCT is also trading at an undemanding FY15F P/B of 0.87x, which we believe is undervalued given its high quality and resilient portfolio. With a cheaper P/B ratio and a higher prospective distribution yield than its S-REITs peers, we initiate coverage on MGCCT with a BUY rating.

Monday, September 22, 2014

Singapore Post Ltd - Groundwork firmly in place

What Happened

SingPost hosted a site tour to view its end-to-end suite of ecommerce logistics services. These range from front-end solutions such as website design to back-end services including warehousing and last-mile delivery.

What We Think

With a full suite of ecommerce logistics solutions, we believe SingPost has laid the groundwork for regional expansion. While most third-party logistics (3PL) providers mainly focus on warehousing and delivery, SingPost’s added services allow it to capture a wider audience, from international brands looking to set up a standalone online retail presence (monobrand channel) to SMEs that want to list their products on an online marketplace (multibrand channel). SingPost views the monobrand segment as a key growth area, given that consumers trust brands’ official websites more than online marketplaces, especially in less ecommerce-ready markets like Indonesia. Moreover, with the exception of website design, the infrastructure and systems needed to run an ecommerce operation for each brand are the same, thus making it highly scalable. As logistics is a volume game, we think that SingPost needs to ramp up order flow to capture efficiency gains and keep its pricing competitive. Order flow is limited by customer acquisitions, which have shown promising signs (doubled from 300 to 600 ecommerce customers as at end-FY14) but still need to expand more rapidly. A potential tie-up with Alibaba could bring in bigger volumes, not only through Alibaba’s expansion into ASEAN, but also a global ecommerce logistics platform that will be made available to third-party users.

What You Should Do

SingPost’s share price has traded sideways since its run-up in Jun when it announced that Alibaba was taking a stake in SingPost. Even the news of a postage rate hike, which we estimate would lead to 6-7% EPS accretion, barely moved its share price. We believe the next re-rating hinges on the potential JV with Alibaba to set up an international ecommerce logistics platform. M&A opportunities in ecommerce logistics also remain a key catalyst for the stock.

SingPost hosted a site tour to view its end-to-end suite of ecommerce logistics services. These range from front-end solutions such as website design to back-end services including warehousing and last-mile delivery.

What We Think

With a full suite of ecommerce logistics solutions, we believe SingPost has laid the groundwork for regional expansion. While most third-party logistics (3PL) providers mainly focus on warehousing and delivery, SingPost’s added services allow it to capture a wider audience, from international brands looking to set up a standalone online retail presence (monobrand channel) to SMEs that want to list their products on an online marketplace (multibrand channel). SingPost views the monobrand segment as a key growth area, given that consumers trust brands’ official websites more than online marketplaces, especially in less ecommerce-ready markets like Indonesia. Moreover, with the exception of website design, the infrastructure and systems needed to run an ecommerce operation for each brand are the same, thus making it highly scalable. As logistics is a volume game, we think that SingPost needs to ramp up order flow to capture efficiency gains and keep its pricing competitive. Order flow is limited by customer acquisitions, which have shown promising signs (doubled from 300 to 600 ecommerce customers as at end-FY14) but still need to expand more rapidly. A potential tie-up with Alibaba could bring in bigger volumes, not only through Alibaba’s expansion into ASEAN, but also a global ecommerce logistics platform that will be made available to third-party users.

What You Should Do

SingPost’s share price has traded sideways since its run-up in Jun when it announced that Alibaba was taking a stake in SingPost. Even the news of a postage rate hike, which we estimate would lead to 6-7% EPS accretion, barely moved its share price. We believe the next re-rating hinges on the potential JV with Alibaba to set up an international ecommerce logistics platform. M&A opportunities in ecommerce logistics also remain a key catalyst for the stock.

Wednesday, September 03, 2014

Singapore Post Ltd - A little help goes a long way

What Happened

SingPost will revise domestic and international postage rates with effect from 1 Oct 2014. This marks the first rate hike since 2006. Domestic postage rates will increase by 4-20 S cts while international postage rates will rise by 5-25 S cts. The registered article fee for international mail will also be raised from S$2.20 to S$2.50. To help mitigate the impact of the postage rate increase, SingPost will be giving out 10m free stamps to households and charities and offer a 5% rebate to SME franked mail customers for the first year.

What We Think

SingPost has been challenged with a 25-32% rise in labour and fuel costs since its last postage rate hike in 2006 and this new rate hike will help SingPost to cope with cost pressures as mail volumes continue to decline. International settlement rates or terminal dues on outbound mail have risen by 43% due to Singapore being re-classified as a “New Target Country” by the Universal Postal Union in 2012. The rate is expected to climb another 37% by 2017, or an estimated S$35m-40m over the next 2-3 years, which we have previously factored into our forecasts. We estimate that the revised postage rates will add S$8m to revenue in 2HFY15 and S$16m (+1.3-1.6%) from FY16 onwards. On the net profit level, the impact will be more pronounced with a 6-7% upgrade to our estimates from FY16 onwards as the price increase should flow through to the bottomline. This is after accounting for the cost of the 10m free stamps in the first year.

What You Should Do

While this news is a positive, we believe the key potential catalysts for the stock are: 1) M&A opportunities in the e-commerce logistics space, and 2) a JV with Alibaba, which can bring in more e-commerce-related volumes. Our rating remains an Add.

SingPost will revise domestic and international postage rates with effect from 1 Oct 2014. This marks the first rate hike since 2006. Domestic postage rates will increase by 4-20 S cts while international postage rates will rise by 5-25 S cts. The registered article fee for international mail will also be raised from S$2.20 to S$2.50. To help mitigate the impact of the postage rate increase, SingPost will be giving out 10m free stamps to households and charities and offer a 5% rebate to SME franked mail customers for the first year.

What We Think

SingPost has been challenged with a 25-32% rise in labour and fuel costs since its last postage rate hike in 2006 and this new rate hike will help SingPost to cope with cost pressures as mail volumes continue to decline. International settlement rates or terminal dues on outbound mail have risen by 43% due to Singapore being re-classified as a “New Target Country” by the Universal Postal Union in 2012. The rate is expected to climb another 37% by 2017, or an estimated S$35m-40m over the next 2-3 years, which we have previously factored into our forecasts. We estimate that the revised postage rates will add S$8m to revenue in 2HFY15 and S$16m (+1.3-1.6%) from FY16 onwards. On the net profit level, the impact will be more pronounced with a 6-7% upgrade to our estimates from FY16 onwards as the price increase should flow through to the bottomline. This is after accounting for the cost of the 10m free stamps in the first year.

What You Should Do

While this news is a positive, we believe the key potential catalysts for the stock are: 1) M&A opportunities in the e-commerce logistics space, and 2) a JV with Alibaba, which can bring in more e-commerce-related volumes. Our rating remains an Add.

Monday, September 01, 2014

Celebrate OSIM's 35th Anniversary with Lee Min Ho - Meet-and-Greet

Date: 27 September 2014 (Saturday)

Time: 3pm

Venue: Causeway Point

Mark your calendars! Korean superstar and drama prince, Lee Min Ho will be coming to Singapore on 27 September to celebrate OSIM's 35th anniversary!

The charming star recently starred in the popular drama “The Inheritors”, which drew legions of fans all over the world. Lee Min Ho has set hearts yet a flutter by becoming the latest celebrity endorser for OSIM’s triple enjoyment massage sofa that can transform into a relaxing lounger or a full-body massage chair.

Time: 3pm

Venue: Causeway Point

Mark your calendars! Korean superstar and drama prince, Lee Min Ho will be coming to Singapore on 27 September to celebrate OSIM's 35th anniversary!

The charming star recently starred in the popular drama “The Inheritors”, which drew legions of fans all over the world. Lee Min Ho has set hearts yet a flutter by becoming the latest celebrity endorser for OSIM’s triple enjoyment massage sofa that can transform into a relaxing lounger or a full-body massage chair.

Friday, August 29, 2014

IHH Healthcare - Optimistic outlook ahead

2Q14 and 1H14 results above

IHH’s 2Q14 and 1H14 core EPS beat expectations, forming 27% and 52% of our previous FY14 forecast respectively. The beat came through organic growth as patient admissions and revenue intensity through new disciplines and ramp-up of operations from various start-up hospitals kicked in. Currency translation had a minimal impact on this set of numbers as the strengthening Singapore Dollar offset the impact of the weakening Turkish Lira after the reported numbers were converted into Malaysian Ringgit. EBITDA excluding contributions from PLife REIT grew 16% yoy to RM435m. As a result, core PATMI jumped 21% yoy to RM179m.

Monitoring Turkish Lira situation

Pertaining to Acibadem, management said that it will monitor its liquidity position to hedge its cashflows by conserving hard currency receipts from medical travellers to service the debts and interest payments of its non-Turkish Lira denominated loans. Almost all of IHH’s FX losses are translational and unrealised.

Reiterate Add

IHH can now better mitigate the effects of higher staff costs and other inflationary pressures through price adjustments, while it extracts greater operating leverage on the back of higher inpatient admissions from its new and existing hospitals. The bulk of the capex programme from 2Q14 to FY16 would be funded using operating cashflows, although bank facilities will be used for the remaining 60% capex for Gleneagles HK (c.RM1bn). Net gearing is healthy at 0.1x, and the management has continued to guide for an upbeat outlook and willingness to drive greater dividend payments. Reiterate Add.

IHH’s 2Q14 and 1H14 core EPS beat expectations, forming 27% and 52% of our previous FY14 forecast respectively. The beat came through organic growth as patient admissions and revenue intensity through new disciplines and ramp-up of operations from various start-up hospitals kicked in. Currency translation had a minimal impact on this set of numbers as the strengthening Singapore Dollar offset the impact of the weakening Turkish Lira after the reported numbers were converted into Malaysian Ringgit. EBITDA excluding contributions from PLife REIT grew 16% yoy to RM435m. As a result, core PATMI jumped 21% yoy to RM179m.

Monitoring Turkish Lira situation

Pertaining to Acibadem, management said that it will monitor its liquidity position to hedge its cashflows by conserving hard currency receipts from medical travellers to service the debts and interest payments of its non-Turkish Lira denominated loans. Almost all of IHH’s FX losses are translational and unrealised.

Reiterate Add

IHH can now better mitigate the effects of higher staff costs and other inflationary pressures through price adjustments, while it extracts greater operating leverage on the back of higher inpatient admissions from its new and existing hospitals. The bulk of the capex programme from 2Q14 to FY16 would be funded using operating cashflows, although bank facilities will be used for the remaining 60% capex for Gleneagles HK (c.RM1bn). Net gearing is healthy at 0.1x, and the management has continued to guide for an upbeat outlook and willingness to drive greater dividend payments. Reiterate Add.

Tuesday, August 19, 2014

Meet the Cast of 'Cafe. Waiting. Love' <等一个人咖啡>

The romance-comedy, Cafe. Waiting. Love. is produced by the same team behind ‘You Are the Apple of My Eye’. In the director’s seat is Chiang Chin-lin, who was also the associate director for ‘You Are the Apple of My Eye’, as well as producer Angie Chai, known for producing hit TV show Meteor Garden.

The movie stars Megan Lai, Hong Kong diva Vivian Chow 周慧敏 and fresh faces Vivian Sung and Bruce.

Cafe. Waiting. Love Star Appearance

Date: 24 August 2014, Sunday

Time: 4.30pm

Venue: Shaw Theatres Lido, Shaw House Level 5

Attendees:

The movie stars Megan Lai, Hong Kong diva Vivian Chow 周慧敏 and fresh faces Vivian Sung and Bruce.

Cafe. Waiting. Love Star Appearance

Date: 24 August 2014, Sunday

Time: 4.30pm

Venue: Shaw Theatres Lido, Shaw House Level 5

Attendees:

- Megan Lai 赖雅妍

- Vivian Sung 宋芸桦

- Bruce 布鲁斯

- Director Chiang Chin Lin 江金霖

Saturday, July 26, 2014

Sheng Siong Group - When the stars align

What Happened

2Q14 earnings have beaten expectations. The upside in margins was led by cost savings from bulk handling and logistical efficiencies, a trend fairly evident since the opening of its distribution centre in 2011. What made the quarter truly stand out were: 1) lower input costs from manufacturing overcapacity in China which boosted margins for house brands, and 2) a lagged price effect for fresh food input costs, which have not yet risen in line with the selling prices.

What We Think

Gross margins moving forward will not sustain at this record-high level (24.7%), as factors like temporary lower input prices for house brands are fleeting. But the broader cost savings from bulk handling and higher fresh food mix will ensure that GP margins stay in the 23.5-24.5% range (vs. 22% in 2011, before efficiencies started to kick in). At ~75% utilisation rate, we think that efficiency gains from the new Mandai distribution centre will help maintain the current margin level, which is already much improved compared to the past. Moving forward, higher costs like foreign levies will dent margins a little, but the more important factor is that competition will remain well-behaved, allowing SSG to pass on any cost increases. Higher costs seem to be hitting a competitor particularly hard. In 2014, we believe that NTUC and SSG gained market share from Giant (which has recently closed a store and is slated to close ~5 more).

What You Should Do

Stay invested in SSG. Even though finding new stores is difficult, prudent cost and labour management can help keep costs under control. Its still-strong free cashflow (FY13: ~S$20m) and net cash position (~S$95m) will see payments for Junction 9 (~S$6m/year) and Tampines (~S$59m in 2014) being met.

2Q14 earnings have beaten expectations. The upside in margins was led by cost savings from bulk handling and logistical efficiencies, a trend fairly evident since the opening of its distribution centre in 2011. What made the quarter truly stand out were: 1) lower input costs from manufacturing overcapacity in China which boosted margins for house brands, and 2) a lagged price effect for fresh food input costs, which have not yet risen in line with the selling prices.

What We Think

Gross margins moving forward will not sustain at this record-high level (24.7%), as factors like temporary lower input prices for house brands are fleeting. But the broader cost savings from bulk handling and higher fresh food mix will ensure that GP margins stay in the 23.5-24.5% range (vs. 22% in 2011, before efficiencies started to kick in). At ~75% utilisation rate, we think that efficiency gains from the new Mandai distribution centre will help maintain the current margin level, which is already much improved compared to the past. Moving forward, higher costs like foreign levies will dent margins a little, but the more important factor is that competition will remain well-behaved, allowing SSG to pass on any cost increases. Higher costs seem to be hitting a competitor particularly hard. In 2014, we believe that NTUC and SSG gained market share from Giant (which has recently closed a store and is slated to close ~5 more).

What You Should Do

Stay invested in SSG. Even though finding new stores is difficult, prudent cost and labour management can help keep costs under control. Its still-strong free cashflow (FY13: ~S$20m) and net cash position (~S$95m) will see payments for Junction 9 (~S$6m/year) and Tampines (~S$59m in 2014) being met.

Thursday, July 24, 2014

Korean Superstar Song Seung Heon to Promote 'Obsessed'

Korean hunk Song Seung Heon 宋承宪 will be coming to Singapore on 25th July to promote his latest erotic film Obsessed!

Singapore Meet-and-Greet Session

Date: 25 July 2014 (Friday)

Time: 7:30pm

Venue: Level B1, Fountain Square, City Square Mall

Singapore Meet-and-Greet Session

Date: 25 July 2014 (Friday)

Time: 7:30pm

Venue: Level B1, Fountain Square, City Square Mall

Thursday, July 17, 2014

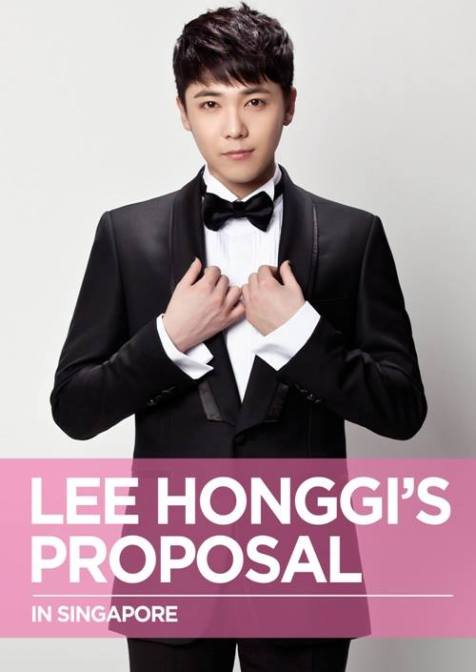

2014 Lee Hong Gi’s Proposal in Singapore

Details of Open Press Conference:

Date: 18 July 2014, Friday

Time: 3pm

Venue: City Square Mall, B1 Fountain Square

Time: 3pm

Venue: City Square Mall, B1 Fountain Square

Tuesday, June 24, 2014

Global Logistic Properties - In three years’ time…

China to drive growth

We acknowledge the risks of higher competition among logistics facilities and land supply constraints but do not expect them to undermine GLP’s market leader position. The combined spending on logistics facilities by GLP, Alibaba and JD.com is less than 5% the required amount for China’s logistics space per capita to equal a third that of the US. As such, we expect demand to more than absorb the oncoming supply of logistics space. In the same vein, the land supply constraints are mitigated by the strategic partners, such as SOEs, COFCO and Sinotrans, which are not only likely to increase land supply but leasing demand as well. We believe GLP will maintain its market leader position in China through the fostering of strategic partnerships and enhancing customer stickiness.

AUM - CAGR of 28%

We expect GLP’s AUM to post a CAGR of 28% over FY15-17 through the injection of stabilised assets into funds/REITs and the investment of committed capital from its development funds. This will be a positive as it not only builds its management fee platform but also enables capital to be recycled into its growing China portfolio.

Reiterate Add

GLP is trading at a 19% discount to RNAV, about 1 s.d. deeper than its historical mean discount of 12%. Additionally, we expect GLP’s RNAV to grow 9% and 2% in FY16 and FY17, respectively, driven by growth in its China assets and value creation from an enlarged fund management portfolio.

We acknowledge the risks of higher competition among logistics facilities and land supply constraints but do not expect them to undermine GLP’s market leader position. The combined spending on logistics facilities by GLP, Alibaba and JD.com is less than 5% the required amount for China’s logistics space per capita to equal a third that of the US. As such, we expect demand to more than absorb the oncoming supply of logistics space. In the same vein, the land supply constraints are mitigated by the strategic partners, such as SOEs, COFCO and Sinotrans, which are not only likely to increase land supply but leasing demand as well. We believe GLP will maintain its market leader position in China through the fostering of strategic partnerships and enhancing customer stickiness.

AUM - CAGR of 28%

We expect GLP’s AUM to post a CAGR of 28% over FY15-17 through the injection of stabilised assets into funds/REITs and the investment of committed capital from its development funds. This will be a positive as it not only builds its management fee platform but also enables capital to be recycled into its growing China portfolio.

Reiterate Add

GLP is trading at a 19% discount to RNAV, about 1 s.d. deeper than its historical mean discount of 12%. Additionally, we expect GLP’s RNAV to grow 9% and 2% in FY16 and FY17, respectively, driven by growth in its China assets and value creation from an enlarged fund management portfolio.

Wednesday, June 11, 2014

Taken By Sheng Siong!

Sheng Siong Group (SSG) made the news once again albeit on a more positive note. This time, SSG is on the offensive side as they exercised an option to take over a commercial property. The three story HDB commercial property is located in Tampines Central and will be bought for $65 million.

The property has a gross floor area of approximately 3,876 square metres and is currently leased to different tenants. SSG will be taking over the occupied spaces progressively based on the expiry of the existing leases. Leases will start to expire this year with the last expiring in 2018.

In the first phase, SSG will begin to operate its store by 2015 which will occupy 910 square metres. It is noted that Giant currently occupies part of the property but as part of the sale, SSG will be taking over that portion once leases expire.

This plan is part of SSG’s strategy to expand its network in areas without its presence. Currently, SSG’s presence in the East side of Singapore is weak as they are mainly concentrated in the Bedok area.

The proposed plan will enable SSG to quickly scale up its operations in the matured Tampines area. They will also be able to take over Giant’s clientele as they will be replacing them in that area. It will allow SSG to take out its competition and expand its presence concurrently.

The property has a gross floor area of approximately 3,876 square metres and is currently leased to different tenants. SSG will be taking over the occupied spaces progressively based on the expiry of the existing leases. Leases will start to expire this year with the last expiring in 2018.

In the first phase, SSG will begin to operate its store by 2015 which will occupy 910 square metres. It is noted that Giant currently occupies part of the property but as part of the sale, SSG will be taking over that portion once leases expire.

This plan is part of SSG’s strategy to expand its network in areas without its presence. Currently, SSG’s presence in the East side of Singapore is weak as they are mainly concentrated in the Bedok area.

The proposed plan will enable SSG to quickly scale up its operations in the matured Tampines area. They will also be able to take over Giant’s clientele as they will be replacing them in that area. It will allow SSG to take out its competition and expand its presence concurrently.

Thursday, May 29, 2014

Singapore Post Ltd - Open sesame

What Happened

Alibaba plans to invest S$312.5m in SingPost for the purchase of 30m existing treasury shares and 190m new ordinary shares at S$1.42/share. This gives Alibaba a 10.35% stake in SingPost, making it the second largest shareholder behind SingTel. The two parties also signed an MOU to negotiate a potential JV that will create a platform for international e-commerce logistics.

What We Think

We are positive on Alibaba’s investment as: 1) the new source of funding will open the door to new investment opportunities in e-commerce logistics regionally, 2) SingPost will benefit from tremendous business volumes originating from Alibaba’s e-commerce businesses, and 3) the enlarged scale of the business will bring cost efficiencies, giving SingPost leverage over its competitors in a price-competitive ASEAN market. We expect the positive impact to show up in Quantium Solutions (higher warehousing and fulfilment demand), Famous Holdings (freight forwarding) and international mail (higher transhipment volumes and last-mile delivery). Near term dilution not a big concern. While SingPost guided that FY14 EPS would have been 10.4% lower with the equity issuance, we think that the dilutive impact will only be in the near term (FY15), as the synergies created and growth from the new JV should outweigh the dilution from FY16 onwards.

What You Should Do

Maintain Add. SingPost is showing steady progress in transforming into a regional e-commerce logistics player, and its collaboration with Alibaba will provide it with fuel to expand more aggressively in the region, with stronger earnings growth potential both organically and via M&As.

Alibaba plans to invest S$312.5m in SingPost for the purchase of 30m existing treasury shares and 190m new ordinary shares at S$1.42/share. This gives Alibaba a 10.35% stake in SingPost, making it the second largest shareholder behind SingTel. The two parties also signed an MOU to negotiate a potential JV that will create a platform for international e-commerce logistics.

What We Think

We are positive on Alibaba’s investment as: 1) the new source of funding will open the door to new investment opportunities in e-commerce logistics regionally, 2) SingPost will benefit from tremendous business volumes originating from Alibaba’s e-commerce businesses, and 3) the enlarged scale of the business will bring cost efficiencies, giving SingPost leverage over its competitors in a price-competitive ASEAN market. We expect the positive impact to show up in Quantium Solutions (higher warehousing and fulfilment demand), Famous Holdings (freight forwarding) and international mail (higher transhipment volumes and last-mile delivery). Near term dilution not a big concern. While SingPost guided that FY14 EPS would have been 10.4% lower with the equity issuance, we think that the dilutive impact will only be in the near term (FY15), as the synergies created and growth from the new JV should outweigh the dilution from FY16 onwards.

What You Should Do

Maintain Add. SingPost is showing steady progress in transforming into a regional e-commerce logistics player, and its collaboration with Alibaba will provide it with fuel to expand more aggressively in the region, with stronger earnings growth potential both organically and via M&As.

Monday, May 19, 2014

Singapore Post Ltd - Post-dated potential

Results highlights

4QFY14 revenue grew 5.9% yoy on the back of: 1) higher transhipment volumes, 2) growth in vPOST shipments, and 3) full recognition of contributions from Lock+Store and Famous Holdings, acquired in 4QFY13. Excluding the two acquisitions, organic revenue growth was 3% – slower than the run-rate of 6-9% in recent quarters due to seasonality and the sale of Clout Shoppe during the quarter. Core net profit declined marginally (-1.3% yoy) as a result of the higher restructuring and development costs (estimated S$15.5m, of which S$9m was for e-commerce and S$6.5m for the mail segment).

Ongoing e-commerce expansion

SingPost is showing promising signs of progress in the e-commerce space, with over 600 e-commerce customers now, double last year’s 300. SingPost is also rapidly expanding its overseas presence – Quantium Solutions (its primary vehicle for e-commerce logistics growth) recently set up a JV in Indonesia to provide warehousing and freight forwarding services, and Lock+Store will soon introduce its self-storage services in Malaysia. SingPost’s strong net cash position of S$170.3m (3QFY14: S$134.6m) leaves room for further acquisitions in the e-commerce logistics space, which can provide potential earnings uplift.

Maintain Add on post-transformation growth potential

SingPost declared a final DPS of 2.5 Scts, bringing total DPS to 6.25 Scts. This rewards investors with an attractive yield of 4.3% while waiting for earnings growth to come post-transformation. We think that SingPost is positioned to benefit from the rising demand for e-commerce logistics solutions in the region, given its low-cost advantage and full suite of services provided.

4QFY14 revenue grew 5.9% yoy on the back of: 1) higher transhipment volumes, 2) growth in vPOST shipments, and 3) full recognition of contributions from Lock+Store and Famous Holdings, acquired in 4QFY13. Excluding the two acquisitions, organic revenue growth was 3% – slower than the run-rate of 6-9% in recent quarters due to seasonality and the sale of Clout Shoppe during the quarter. Core net profit declined marginally (-1.3% yoy) as a result of the higher restructuring and development costs (estimated S$15.5m, of which S$9m was for e-commerce and S$6.5m for the mail segment).

Ongoing e-commerce expansion

SingPost is showing promising signs of progress in the e-commerce space, with over 600 e-commerce customers now, double last year’s 300. SingPost is also rapidly expanding its overseas presence – Quantium Solutions (its primary vehicle for e-commerce logistics growth) recently set up a JV in Indonesia to provide warehousing and freight forwarding services, and Lock+Store will soon introduce its self-storage services in Malaysia. SingPost’s strong net cash position of S$170.3m (3QFY14: S$134.6m) leaves room for further acquisitions in the e-commerce logistics space, which can provide potential earnings uplift.

Maintain Add on post-transformation growth potential

SingPost declared a final DPS of 2.5 Scts, bringing total DPS to 6.25 Scts. This rewards investors with an attractive yield of 4.3% while waiting for earnings growth to come post-transformation. We think that SingPost is positioned to benefit from the rising demand for e-commerce logistics solutions in the region, given its low-cost advantage and full suite of services provided.

Tuesday, April 22, 2014

CMA shareholders should stand their ground against 'fair offer'

THE CapitaLand (CL) offer for the 35 per cent of the CapitaMalls Asia (CMA) shares they do not own is yet another example of the lack of respect for minority shareholders. The post-IPO performance of CMA shares and the paltry premium over the IPO price and book value multiple should concern all CMA shareholders.

At the November 2009 CMA IPO, all of the proceeds went to CapitaLand and none were invested into CMA. Thus the IPO and current offer are just asset trades for CL with no strategic benefit for CMA shareholders. Prior to the IPO, CL shares peaked at $8.60 and during the financial crisis fell almost 80 per cent. A few months later, CMA's IPO was priced at $2.12, closed the first day at $2.30 and the multiple of book value offered was 1.55x. The current offer of $2.22 is valued at a thin 1.2x book value.

Yet, now more than four years later, CL wants to pay only a 4.7 per cent premium to the IPO price, a 3.4 per cent discount to the day one closing price and a 23 per cent discount to the IPO book value multiple. Has CMA really deteriorated that much over the last four years?

At the time of the IPO, CMA had 59 completed projects and today there are 85, a 44 per cent increase. In 2013 vs 2012, revenue, profit and the asset value per share were all up about 10 per cent and operating income increased a whopping 40 per cent. Looking back to the IPO, in 2009, profit was $388 million and for 2013 it was $600 million, an increase of 55 per cent. Total equity in 2009 was $5.5 billion and at year-end 2013, it is $7.2 billion, more than a 30 per cent increase. So operating performance since the IPO has been quite strong and hardly justifies a discounted multiple to book value and a discount to the closing price after the IPO.

Tuesday, April 15, 2014

CAPITALAND MAKES S$3.06 BILLION OFFER FOR CAPITAMALLS ASIA

CapitaLand has made an offer of S$3.06 billion for the full acquisition of its subsidiary CapitaMalls Asia, which it now owns 65 per cent of.

The offer stands at S$2.22 per share, in cash, and is at a 23 per cent premium over its closing price last Friday.

This acquisition will allow CapitaLand, which is almost 40 per cent owned by Temasek Holdings, to better consolidate its business strategies with CapitaMalls Asia in a movement called “One CapitaLand”.

The company said, “The ‘One CapitaLand’ strategy seeks to harness the key strengths of its various business units to create differentiated real estate projects and enhance overall project returns.”

Explaining, CapitaLand continued, “For example, the pre-sales of residential units help fund development costs and improve project cash flows whilst mall connectivity enhances the appeal to commercial tenants and serviced residence customers. Malls in integrated developments are likely to enjoy higher foot traffic and a captive catchment from integrated offices and serviced residences.”

The listed CapitaMalls Asia, will be taken private post-deal.

Explaining, CapitaLand continued, “For example, the pre-sales of residential units help fund development costs and improve project cash flows whilst mall connectivity enhances the appeal to commercial tenants and serviced residence customers. Malls in integrated developments are likely to enjoy higher foot traffic and a captive catchment from integrated offices and serviced residences.”

The listed CapitaMalls Asia, will be taken private post-deal.

CapitaMalls is one of South East Asia’s largest mall operators with more than 100 shopping malls, with a third of its revenues coming from Singapore, and more than 40 per cent from China.

Wednesday, April 02, 2014

Suntec REIT: Placed For Better?

Analysts were surprised when Suntec REIT (Sun) decided to issue new shares for placement to institutional and private investors. The trust raised net proceeds of $341.1 million which will be used to repay its existing debts that are maturing this year.

This came as a surprise to analysts as Sun had just issued $310 million worth of medium-term notes for refinancing purposes.

Adding the recent debt and equity issue, Sun should have enough funds for its refinancing needs this year. Sun is not expected to raise additional funds this year as the next major refinancing is anticipated to be in 2015.

This share placement will strengthen the balance sheet as its debt level will be reduced from 39.1 percent to 35 percent. However, the Distribution Per Unit (DPU) will be lowered due to a dilution of shares from the new issue.

Some market watchers question the decision for the trust to raise funds through equity as interest rates are still low. The cost for refinancing might be higher should Sun decide to seek funds through debt in 2015 as it will clash with projections of an interest rate hike by the Federal Reserve.

Looking at a long term perspective, Sun is still expected to perform with its quality portfolio. The trust's portfolio consists of commercial properties (retail and office) which includes Suntec City, Park Mall, One Raffles Quay and Marina Bay Financial Center.

Currently, the trust enjoys a high occupancy rate of above 90 percent. Sun is also in the process of diversifying its portfolio with the recent acquisition of an Australian office building which will complete its construction by 2016.

This came as a surprise to analysts as Sun had just issued $310 million worth of medium-term notes for refinancing purposes.

Adding the recent debt and equity issue, Sun should have enough funds for its refinancing needs this year. Sun is not expected to raise additional funds this year as the next major refinancing is anticipated to be in 2015.

This share placement will strengthen the balance sheet as its debt level will be reduced from 39.1 percent to 35 percent. However, the Distribution Per Unit (DPU) will be lowered due to a dilution of shares from the new issue.

Some market watchers question the decision for the trust to raise funds through equity as interest rates are still low. The cost for refinancing might be higher should Sun decide to seek funds through debt in 2015 as it will clash with projections of an interest rate hike by the Federal Reserve.

Looking at a long term perspective, Sun is still expected to perform with its quality portfolio. The trust's portfolio consists of commercial properties (retail and office) which includes Suntec City, Park Mall, One Raffles Quay and Marina Bay Financial Center.

Currently, the trust enjoys a high occupancy rate of above 90 percent. Sun is also in the process of diversifying its portfolio with the recent acquisition of an Australian office building which will complete its construction by 2016.

Wednesday, March 26, 2014

Singapore Post Ltd - More than just a mailman

The mailman finds a new job

SingPost has all the last-mile assets to deliver mail anywhere in Singapore. Mail delivery is a sunset industry but SingPost’s assets are still good for delivering a variety of goods in the world of e-commerce. The business only requires tweaks to 1) refine its infrastructure to deliver parcels, in addition to mail; 2) add last-mile delivery capabilities in Asia; and 3) add end-to-end e-commerce logistics solutions – all of which SingPost is doing via investments or M&A.

Filling the gap in e-commerce logistics

SingPost’s competitive advantage over its postal peers and other 3PL (third-party logistics) players is its ability to provide a full spectrum of e-commerce logistics solutions at low costs. This is made possible by its access to: 1) postal-to-postal rates (governed by the Universal Postal Union); 2) bilateral agreements with other countries; and 3) partnerships with low-cost couriers. It also constantly enhances its capabilities with acquisitions. As no other postal player in Asia has moved into e- commerce (due to government mandates) and 3PL providers do not have access to such low delivery costs, SingPost has a clear advantage in costs and service offerings.

Paid to wait

SingPost used to be one of Singapore’s high yield stocks although it was operating in a sunset industry. With its new push into e-fulfilment, it will have a unique blend of growth and yield. The old business will still fund its dividends, while its net cash of S$135m will allow for earnings-accretive acquisitions that can aid its strategic repositioning. Our estimates have not factored in complementary assets and acquired earnings from its S$135m net cash pile. In the meantime, investors are receiving an attractive dividend yield of 4.7% while waiting for SingPost to turn into a swan.

SingPost has all the last-mile assets to deliver mail anywhere in Singapore. Mail delivery is a sunset industry but SingPost’s assets are still good for delivering a variety of goods in the world of e-commerce. The business only requires tweaks to 1) refine its infrastructure to deliver parcels, in addition to mail; 2) add last-mile delivery capabilities in Asia; and 3) add end-to-end e-commerce logistics solutions – all of which SingPost is doing via investments or M&A.

Filling the gap in e-commerce logistics

SingPost’s competitive advantage over its postal peers and other 3PL (third-party logistics) players is its ability to provide a full spectrum of e-commerce logistics solutions at low costs. This is made possible by its access to: 1) postal-to-postal rates (governed by the Universal Postal Union); 2) bilateral agreements with other countries; and 3) partnerships with low-cost couriers. It also constantly enhances its capabilities with acquisitions. As no other postal player in Asia has moved into e- commerce (due to government mandates) and 3PL providers do not have access to such low delivery costs, SingPost has a clear advantage in costs and service offerings.

Paid to wait

SingPost used to be one of Singapore’s high yield stocks although it was operating in a sunset industry. With its new push into e-fulfilment, it will have a unique blend of growth and yield. The old business will still fund its dividends, while its net cash of S$135m will allow for earnings-accretive acquisitions that can aid its strategic repositioning. Our estimates have not factored in complementary assets and acquired earnings from its S$135m net cash pile. In the meantime, investors are receiving an attractive dividend yield of 4.7% while waiting for SingPost to turn into a swan.

Friday, March 07, 2014

OUE Hospitality Trust - A more stable hospitality play

Stability anchors

The stability of OUEHT is anchored by the Mandarin Orchard Singapore (MOS) master lease and Mandarin Gallery (MG) retail segment. We estimate that c.70% of OUEHT’s FY14 revenue is fixed through its retail rent and fixed rent from a hotel master lease. This is higher than hotel peers such as CDLHT and FEHT, which has a near 50:50 split between hotel fixed and variable revenue, and a lesser proportion of retail. Additionally, it has minimal forex and interest-rate risks as all its assets are based in Singapore and it has hedged 100% of its debt (set to expire in 2016 and 2018).

Embedded organic growth

We expect revenue to grow organically by c.3% in FY14. This is largely led by MOS’s S$23.1m AEI, which will yield an additional 26 rooms and refurbish 430 rooms. The AEI will be sponsor-funded and completed in phases during FY14-15. So far, renovated rooms have registered 15% increment in room rates. We expect this to lead to 2% growth in RevPAR for FY14-15. There is embedded growth in MG’s rent as about 50% of the leases by NLA have step-up structures with annual step-up of c.4.7%.

Supply risk manageable

The upcoming supply of hotel rooms is a risk, but a manageable one, in our view, because 1) historical growth in supply has lagged behind demand, 2) upcoming supply is largely in the mid-tier segment and 3) supply is supported in the mid- to long-term by tourist arrivals . We have factored in 1% drop in occupancy for 2014 and 2015, which will be more than offset by an estimated 3% increment in average room rates.

The stability of OUEHT is anchored by the Mandarin Orchard Singapore (MOS) master lease and Mandarin Gallery (MG) retail segment. We estimate that c.70% of OUEHT’s FY14 revenue is fixed through its retail rent and fixed rent from a hotel master lease. This is higher than hotel peers such as CDLHT and FEHT, which has a near 50:50 split between hotel fixed and variable revenue, and a lesser proportion of retail. Additionally, it has minimal forex and interest-rate risks as all its assets are based in Singapore and it has hedged 100% of its debt (set to expire in 2016 and 2018).

Embedded organic growth

We expect revenue to grow organically by c.3% in FY14. This is largely led by MOS’s S$23.1m AEI, which will yield an additional 26 rooms and refurbish 430 rooms. The AEI will be sponsor-funded and completed in phases during FY14-15. So far, renovated rooms have registered 15% increment in room rates. We expect this to lead to 2% growth in RevPAR for FY14-15. There is embedded growth in MG’s rent as about 50% of the leases by NLA have step-up structures with annual step-up of c.4.7%.

Supply risk manageable

The upcoming supply of hotel rooms is a risk, but a manageable one, in our view, because 1) historical growth in supply has lagged behind demand, 2) upcoming supply is largely in the mid-tier segment and 3) supply is supported in the mid- to long-term by tourist arrivals . We have factored in 1% drop in occupancy for 2014 and 2015, which will be more than offset by an estimated 3% increment in average room rates.

Thursday, March 06, 2014

Global Logistic Properties - Second portfolio in Brazil

What Happened

GLP announced that it plans to acquire a portfolio of 34 completed assets (1.2m sq m in GLA) in Brazil from BR Properties S.A (BRPR) for c.US$1.36bn or BRL3.18bn. This transaction is subject to due diligence and if successful, will be funded through internal funds. The portfolio is 99% occupied with 86% of the total area located in Sao Paulo and Rio de Janeiro.

What We Think

We understand that BRPR is a motivated seller, with plans to reduce its high debt obligations through this sale. This portfolio was initially to be sold to WTGoodman, a JV between Goodman Group and WTorre (Brazil-based developer) for the same BRL3.18bn price. We understand that the exclusivity agreement has expired and BRPR has chosen to enter into the transaction with GLP instead. We are unsure of the reasons that the sale to WTGoodman fell through. The sale price implies a 5% discount to its Nov 2013 appraised value (reflected in BRPR’s latest 4Q13 results) or at a c.9% cap rate, which looks reasonable. We understand that the leases are structured on a triple net basis (NOI margins of 95-97%), with yearly inflation-linked step-ups that will provide surety of cash flows. Strategically, we would prefer GLP to deploy its excess capital to China, a region with clearer growth trends. That said, we expect GLP to inject a portion of the Brazil assets into its existing fund platform (or create new funds), with the ultimate goal of growing its AUM fee income. GLP guides that its optimal target for Brazil remains below 10% of total assets. China will remain its core market, with GLP still having the firepower to increase its China investments by 40% yoy in FY15.

What You Should Do

If the deal materialises, the assets that are eventually injected into its funds are likely to result in upsides to GLP’s RNAV. We maintain our Add rating.

GLP announced that it plans to acquire a portfolio of 34 completed assets (1.2m sq m in GLA) in Brazil from BR Properties S.A (BRPR) for c.US$1.36bn or BRL3.18bn. This transaction is subject to due diligence and if successful, will be funded through internal funds. The portfolio is 99% occupied with 86% of the total area located in Sao Paulo and Rio de Janeiro.

What We Think

We understand that BRPR is a motivated seller, with plans to reduce its high debt obligations through this sale. This portfolio was initially to be sold to WTGoodman, a JV between Goodman Group and WTorre (Brazil-based developer) for the same BRL3.18bn price. We understand that the exclusivity agreement has expired and BRPR has chosen to enter into the transaction with GLP instead. We are unsure of the reasons that the sale to WTGoodman fell through. The sale price implies a 5% discount to its Nov 2013 appraised value (reflected in BRPR’s latest 4Q13 results) or at a c.9% cap rate, which looks reasonable. We understand that the leases are structured on a triple net basis (NOI margins of 95-97%), with yearly inflation-linked step-ups that will provide surety of cash flows. Strategically, we would prefer GLP to deploy its excess capital to China, a region with clearer growth trends. That said, we expect GLP to inject a portion of the Brazil assets into its existing fund platform (or create new funds), with the ultimate goal of growing its AUM fee income. GLP guides that its optimal target for Brazil remains below 10% of total assets. China will remain its core market, with GLP still having the firepower to increase its China investments by 40% yoy in FY15.

What You Should Do

If the deal materialises, the assets that are eventually injected into its funds are likely to result in upsides to GLP’s RNAV. We maintain our Add rating.

Subscribe to:

Posts (Atom)